Many day traders wake up very early to do their research every day and get ready for nature. In mid-November, the price starts to rise, marked by a couple wider ranging black bars. At the start of the year, the price continued to escalate, dominated by black rising bars.

Realized Volatility Analysis 101. A beginner’s guide to analyzing … – DataDrivenInvestor

Realized Volatility Analysis 101. A beginner’s guide to analyzing ….

Posted: Sun, 24 Jul 2022 07:00:00 GMT [source]

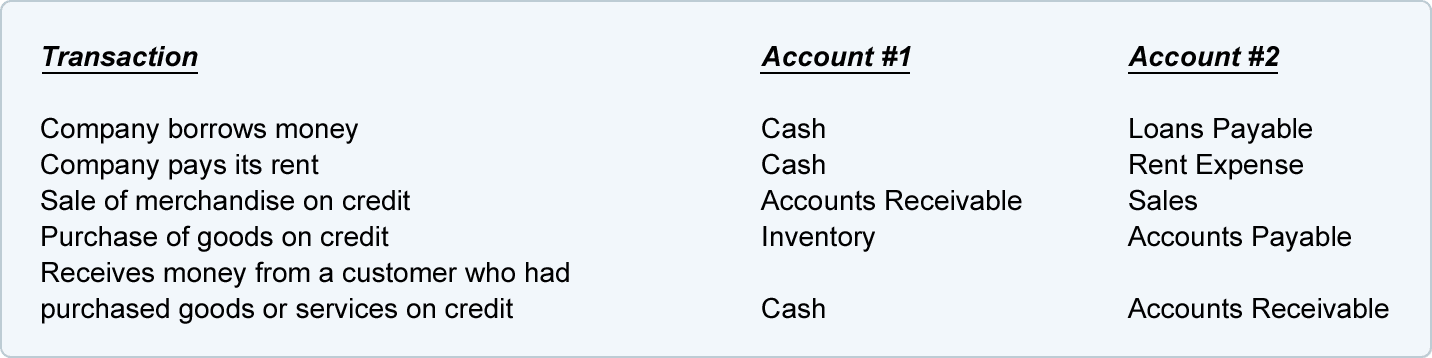

You do this by simply going to the properties and selecting show Open-High-Low-Close. This will show you these numbers at the top part of the chart. These terms are self-explanatory and you have likely used them before. This means that the open high low strategy fits very well with the scaling in and out strategy.

OHL strategy for day trading

You should experiment with different time settings to discover what works best for you. Unlike other indicators like the RSI and moving averages, OHLC does not provide pointers as to where the price of an asset will move. Instead, it helps provide an indication as to how the assets are trading and the ranges to watch. Technical analysis is a trading strategy that uses charts and combines them with indicators. For example, if your favorite stock or index has an ATR of $10 and the stock has already done $2 at the open, you have a potential profit margin of $8 for that day.

- There is also the same problem when you are looking at shares of companies listed in the United States.

- Keep in mind that the ATR indicator should be used only as a gauge of market volatility.

- Even though this is an intraday trading method, experts recommend that individuals should avoid trading against a stock’s trend.

- OHLC charts show more information than line charts which only show closing prices connected together into a continuous line.

- As for the stop-loss strategy, you can hide your protective stop-loss order at the previous day’s close.

Intraday traders opting for the open high low strategy must give more emphasis on the opening trading session as that’s when they have high chances of maximising their returns. When the price rises over a period, the right line will be above the left, since the close is above the open. If the price falls during a period, the right line will be below the left, since the close is below the open. At the same time, scaling-out means closing a portion of your position either for a profit or for a loss. Keep in mind that the ATR indicator should be used only as a gauge of market volatility. Overall, the ATR still remains a good tool to measure the stock market’s high volatility options, but it needs to be used with other key technical price points on your chart.

The Detailed Guide to Starting an LLC for a Day Trading Business

For the intraday open high low strategy to work well, traders must trade in large quantities, for small targets. As a trader, you need to make a quick entry and swift exit to book profits. Note that it is challenging to manage the strategy since it involves a high risk-reward ratio. The aggressive trading strategy is to wait for the first open light to form. There are several day trading strategies when using OHLC bar charts.

- That said, the reverse will hold true if the value is identical for open and high.

- This will show you these numbers at the top part of the chart.

- In the past few months after the completion of the EPAT course, he developed an Algorithmic trading system and a back-tester module.

- The OHL stock has the tendency to experience a pullback pattern especially if the first candle has a big price range.

- If you want to learn various aspects of Algorithmic trading then check out the Executive Programme in Algorithmic Trading (EPAT).

At the same time, the first-minute candle expanded more than $4 leaving us with a profit potential of $11. However, the stock price only moved an additional $9, which could have been our profit target ohlc intraday strategy for the day. As for the stop-loss strategy, you can hide your protective stop-loss order at the previous day’s close. Or, alternatively, you can place it above (below) the current opening price.

Interpreting OHLC Charts

There are traders who prefer trading in a period of low volatility and others who prefer trading in a period of high volatility. For example, if you are trading Apple, the open price will be where the price starts the day. This price is determined by the demand and supply of the asset at the start of the day. If the open and close are close together, it shows indecision, since the price couldn’t make much progress in either direction. If the close is well above or below the open, it shows that there was strong selling or buying during the period.

A Short-Term Trading Strategy For Good Times And Bad – Seeking Alpha

A Short-Term Trading Strategy For Good Times And Bad.

Posted: Mon, 06 Dec 2021 08:00:00 GMT [source]

The two help traders get information about the state of the economy. As a result, they can use this information to predict how a currency or an asset will move. Generally, the trading volume in the market is high in the first 15 minutes, leading to more favourable trading opportunities.

What is not an Open High Low Close

Let’s see how to use the open high low close formula to determine the type of day (bullish or bearish). Make sure to also read our guide on day trading for beginners. Login to your trading account and ensure you have sufficient balances to execute your trade. If the retail price and the high (or low) price are the same, it is most obvious that a conversion trend has begun. Simply put, the rating is the process of adding value to your company.

The first advantage of the OHLC strategy is that it’s easy to use. Both novice traders and experienced day traders can benefit from this trading strategy. Secondly, this trading method doesn’t require prolonged analysis. This means you don’t have to spend countless hours analyzing the market. OHLC charts show more information than line charts which only show closing prices connected together into a continuous line. OHLC and candlestick charts show the same amount of information, but they show it in a slightly different way.

At the start of February, there are large red bars, much larger than any seen during the prior advance. The following is an OHLC chart for the S&P 500 SPDR ETF (SPY). Overall rises are typically marked by a greater number of black bars, like the period at the start of October. Trough mid-November the price moves slightly higher but mostly sideways, marked by more alternating bar colors. Next, let’s see how to set targets with the OHL strategy for day trading. If your preferred stock or index has an ATR of $10 and has since hit $2 outside, the possible profitability for the day is $8.

Many studies have shown that the intraday high or low of the day is made within the first 15-minutes of the day. Other researches show that it’s within the first 5 minutes of the day. This should not come as a surprise especially if you’re a day trader because you can see this sort of price action all the time. The strategy is one in which a buy signal gets generated when an index or a stock has the same value for both, open and low. Conversely, the sell signal is generated when the index or stock has the same value for both, open and high.

Duda das Bonfinhas pega carona no sucesso com seu novo hits Uber Cabaré

Duda das Bonfinhas pega carona no sucesso com seu novo hits Uber Cabaré  Bárbara Sheldon corre a Paris para comprar enxoval de luxo

Bárbara Sheldon corre a Paris para comprar enxoval de luxo  Lenda, Memória e Imagem: Documentário Resgata História de Mário Juruna e os Encantos de Barra do Garças

Lenda, Memória e Imagem: Documentário Resgata História de Mário Juruna e os Encantos de Barra do Garças